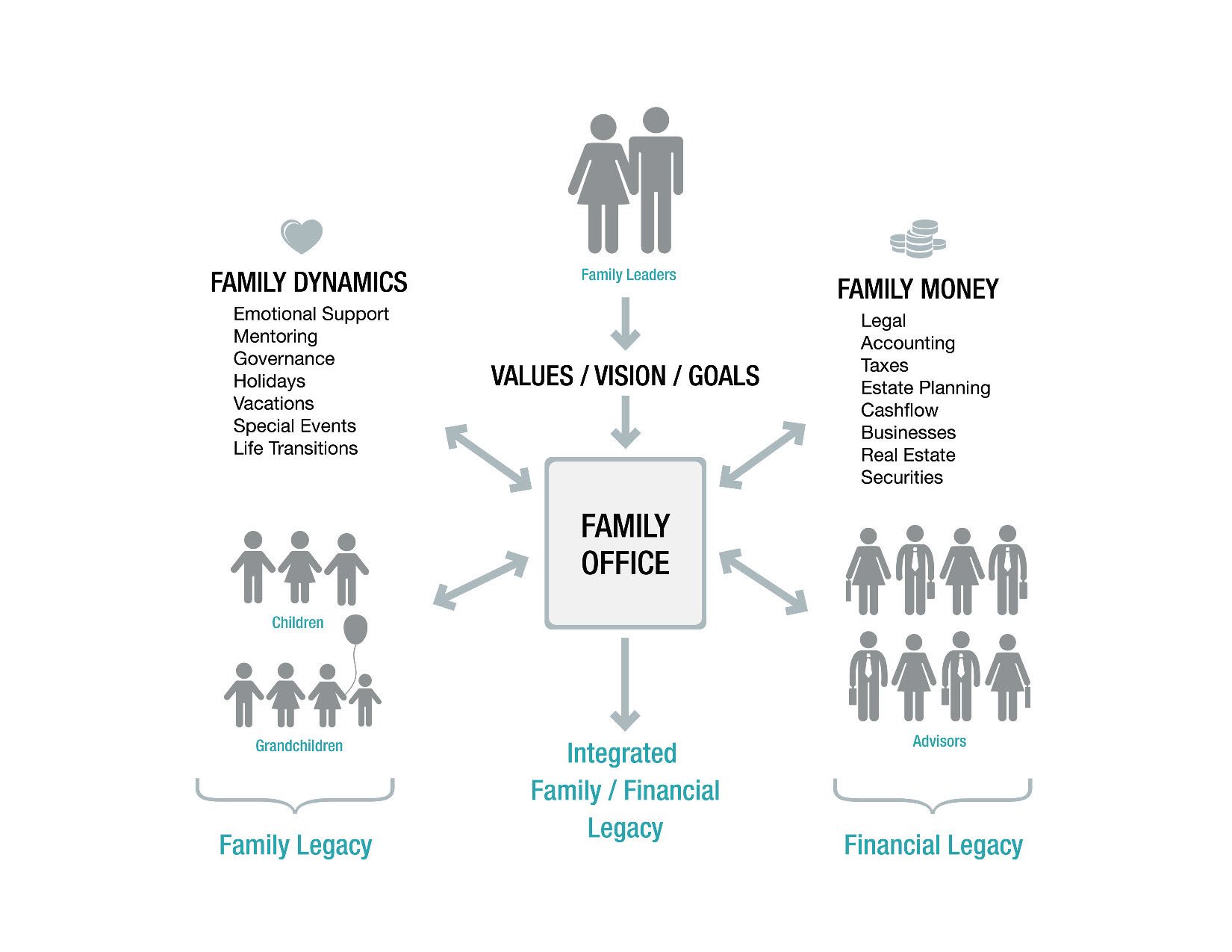

Family money. Family dynamics.

Your need for advice changes over time.

At first, you can do most things yourself. As your family wealth grows, your financial and interpersonal affairs require more oversight, coordination and administration.

Every family office is unique, but their underlying function is universal.

A family office is a multi-generational lynchpin uniting the family dynamics with the family money. The ultimate role of a purposeful family office is the sustainability of an integrated family and financial legacy consistent with the family’s collective values, vision, and goals.

Is a family office right for you?

Those who have a family office see it as an extension of themselves. Do you:

-

Feel responsible to organize your family’s affairs and get things done?

-

Tend to financial matters in a way to make careful, purposeful decisions?

-

Collaborate with family members on the future of the family?

-

Oversee the well-being of each family member and the family as a unit?

-

Rely on the advice of a variety of trusted professionals?

-

Plan for those who would fill your role in your absence?

-

Continuously look for a better way?

A family office saves you time and money by eliminating unnecessary expenses and waste and coordinating your advisory team. Additionally, a family office enriches your family dynamics with more relevant and enjoyable planned interaction.

We provide an experienced team of devoted professionals, a proven process – the Superplan® – and state of the art facilities and technology to bring the families we serve personalized strategic family wealth guidance at a cost effective price.

"Structure not only increases our chance of success; it makes us more efficient at it."