When Life Events Call for Financial Decisions – Part 1: Business Sale

by Buddy Thomas

Many of us understand the need for having a sound financial roadmap, but most wait until a major life event to lay one out. While planning for the handling of large profits or business sales proceeds is typically a good problem to have, it does come with its own unique challenges.

Horror stories abound about those who failed to manage their newfound wealth simply due to a lack of experience in handling sudden money. Even professionals adept at money management have been known to make costly mistakes because they were unfamiliar with this lifestyle-altering transition. The difference between a family who loses these types of assets and those who leverage business sale profits to provide income for themselves and their family for generations can be in working with a specialist experienced at handling such large sums of wealth. The key is in a trained professional’s ability to take the time to methodically plan and implement the integration of these assets in line with a person’s goals and values.

If your business is a major part of your net worth, preserving its value is always a major concern. When it’s time to transfer or sell, the timing, terms and tax implications of the transaction can affect your personal wealth significantly. Financial planners must, regardless of the actual amounts in question, coordinate business transition planning with tax reduction and investment and wealth management advice. Doing so will result in the highest possible, after tax sale proceeds, while also ensuring that their client is positioned to control their cash flow, manage their portfolio, and direct their legacy as they see fit.

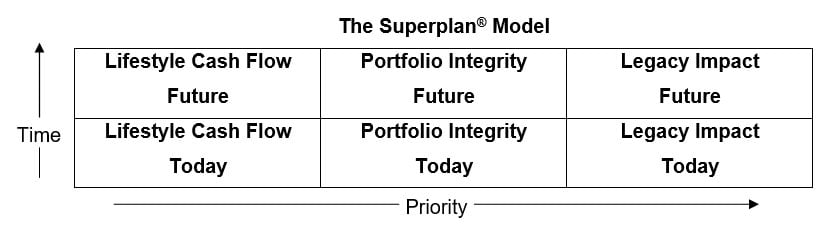

An effective way for clients and planners to do this is to first organize financial decisions based on these three categories and then prioritize them in terms of their desired outcomes today and in the future.

While this approach may sound complicated, it’s a commonsense process that can help you decide what is most important to you and help you focus on getting things done. The key point here is to think about how the sale of a business and the proceeds from it affect all of your plans and priorities.

It’s the business of every client and financial planner to help anticipate life’s challenges and proactively solve them. The sale of a business is no exception.

Know someone who is overwhelmed by this dilemma? Here is how you can help:

- Forward this e-mail to them.

- Have them contact us. Make sure they mention your referral so we can send you a gift as a token of our thanks for your trust and confidence.

- Tell us to contact them. We’ll only do so after they’ve given you permission for us to do so.

Buddy Thomas is Founder and Chief Planning Officer of Superior Planning. He can be reached at buddy@superplan.com

Buddy Thomas is Founder and Chief Planning Officer of Superior Planning. He can be reached at buddy@superplan.com